I’m a news junkie, and lately there have been an overwhelming number of reports on inflation. Whether on TV or in the paper, it seems every day I hear about prices going up…but is that really what inflation is?

My 20 years in the economic and investment world have taught me a lot about inflation. Early on I did a lot of reading, but it took some time for the true mechanics of inflation to really sink in. My goal is to share my thoughts with you on this subject as simply as possible, because I feel like understanding this matter is essential to maximizing strategy and ongoing profitability.

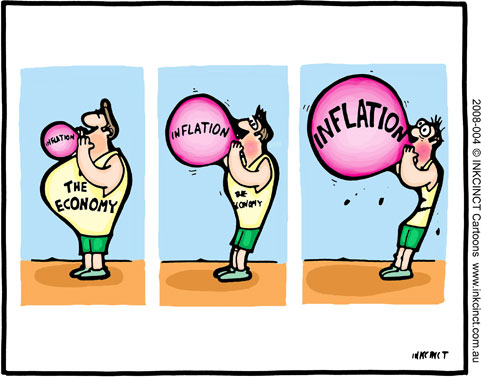

Generally, when you hear the term “inflation” in the news, it’s associated with rising prices. Rising prices is actually the result of inflation, not inflation itself. Let me explain this with a little history lesson:

Back in the Roman days, the government, like all governments, wanted to spend more money. They faced the same issues we do today, where they would raise taxes to have money to spend, but they could only raise them so much before the people would revolt. In order to keep to their agendas, they got creative and found other ways to get money from the people, outside of raising taxes.

In those days, money was made of real gold and silver since there was no printing press. What they did was take coins in and clip them. This means that they would secretly skim the edges off of each coin and mold it back together to make new coins, thus creating more money. Merchants began to notice that some coins being used for purchases were smaller, having less silver or gold, and thus were worth less. To compensate, they would increase the cost of their items to offset the lower value of the smaller coins.

THUS THE INFAMOUS RISING OF PRICES OCCURRED!

If that makes any sense to you, then you now understand what inflation really is…an increase in the AMOUNT OF MONEY in circulation, not rising prices, which is the result. According to the basic law of supply and demand, we all know that when we have a lot of something, it becomes less valuable. When the dollar you have is suddenly worth less than a dollar, business will demand more of it to compensate.

In today’s society, the government doesn’t have to clip coins; they just print more money based supposedly on the value of gold. When we print more money than the value of our gold, it causes the inflation effect. A business’s profitability will erode quickly if it can’t adjust to money becoming less valuable. There are several concerns as to the financial effect of inflation, but awareness of what is happening is the first step to learning to how deal with it.

Richard Maybury gives the history and simplest explanation of inflation I have ever seen in his book Whatever Happened to Penny Candy?