How Important is the WHY in your “Why?”

My entire life there’s always been this ingrained curiosity about the world, people, how things work and especially about business. “Why?” is and always has been commonplace in my vocabulary, asking anyone about anything I came across. My family, business partners and team hammer back…..”WHY! WHY! WHY! Why do you ask why so much”?!

It makes me pause and wonder why it bothers them at times or why they joked about it, because I see it as something so natural that everyone should do it.

Over time I’ve found lots of evidence that asking “why” is a good thing. The root, or “real” problem or situation is usually revealed when you continually ask why. Some people ask “why” once, get their answer, and are satisfied. I keep asking until I get the full story, and it’s come in handy with the cultural barriers we experience with our office in India.

I enjoy a nice “Ah Ha!” moment, and move on thinking that this is how it should be done.

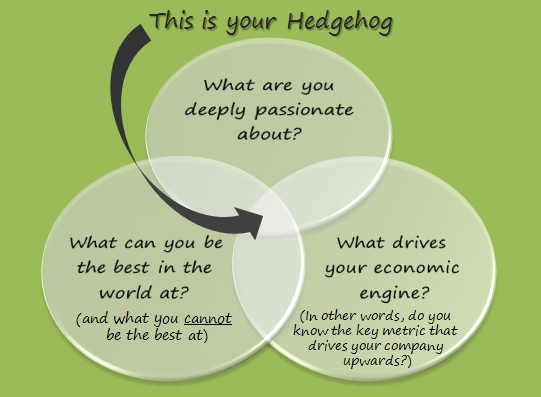

Even the business guru Jim Collins supported my theory in his Harvard Business School paper on getting to your business core purpose. He talked about an exercise where you ask yourself WHY your company exists, outside of earning a paycheck. After each answer you ask WHY again, 5 times each, to help find the deeper underlying meaning of why you are in business. As I chuckle to myself, I think “See mother, these “why’s” are the real deal!!”

This all changed for me when I attended a local EO learning event on hiring the right people by Randy Street. This all day event captured most of what was in his bestselling book WHO, as well as the Topgrading process. Randy described how, in their research, they determined that “Why” questions come across with judgment, either in our body language or tone. He added that this holds back the communication and flow of conversation. Using “What”, “How” or “Tell me more” responses allow you to dig deeper without putting people on the defensive.

After all this time, now I get it. “Why” works in the right context, but I am sure my “Why’s” were coming across a little too judgmental, or it was annoying to ask so many times. These days I try to think about how I ask questions, and use a lot of “so what happened then”, “how did that turnout”, or “tell me more about that” kind of inquiries.