Make the Trend Your Friend

Mary Meeker recently released her annual overview of internet trends, and I found it to be very insightful. You may remember that I have discussed Mary’s research and opinions on this topic in some of my previous blogs. She pushed forward as a leader in this space with different investment banking firms and is now a partner at one of the most prestigious venture capital firms, Kleiner Perkins.

Meeker’s overview includes more than one-hundred slides, so I have summarized some of what jumped out at me. The general theme is that internet growth is still significant and mobile adoption is still in the early stages. Many of the slides show examples of how this connected world is creating the Re-Imagination of everything.

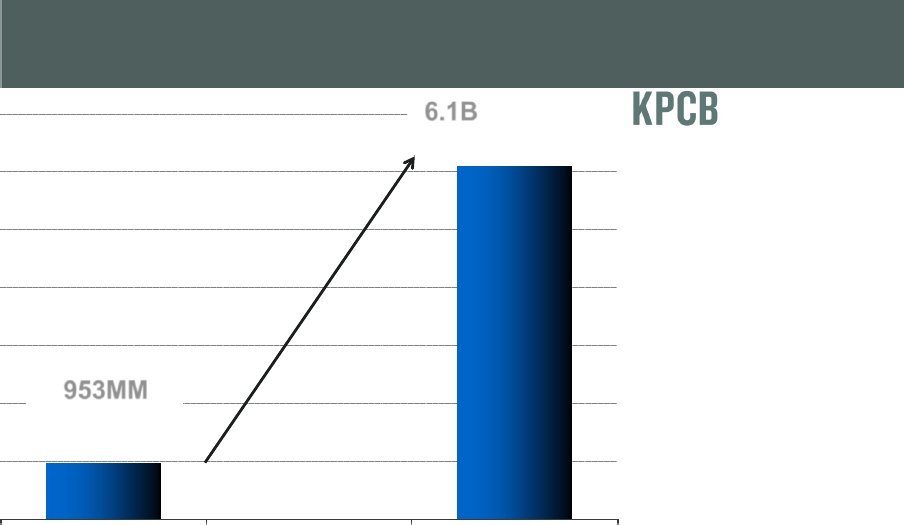

The Smartphone has penetrated only 953 million users when compared to the 6.1 billion mobile phone subscriptions as shown on slide 11. This is a huge  upside. Think about all the new businesses and people considering apps moving forward. Is your business prepared to benefit from this growth?

upside. Think about all the new businesses and people considering apps moving forward. Is your business prepared to benefit from this growth?

Next, on slide 10, compare the global penetration between the Android and iPhone shipments. Android has over 250 million compared to over 60 million with the iPhone. This is a four times difference, and it makes you think about for which one you would build an app. Looking at your demographic, area, and global reach will help to determine if you choose to create an app for one or both.

Slide 18 shows India’s usage of the internet on a desktop has decreased over time, and their usage of internet on mobile devices has increased over the period 12/08 to 5/12. Mobile usage has currently surpassed that of desktops, which should be considered for the monetization of sites. Most sites make more money from ads on the desktop than on mobile. This will changes things.

Mary also makes several points about how things are changing in the world with the internet. In 2010, after 305 years, newspaper ad revenue was surpassed by internet (slide 32). The trend lines for the newspaper ad revenue were declining much faster than the internet was sloping up.

From a technology investment perspective, be careful. Look at slide 108. Out of the 1,720 IPOs over the periods 1980 and 2002, only 2% of these companies accounted for 100% of net wealth creation.

Mary states that the “Magnitude of upcoming change will be stunning. We are still in spring training.” She gives a long list of reasons in slide 85. A few key elements include nearly ubiquitous high speed wireless access in developed countries, fearless and connected entrepreneurs, and inexpensive devices and services, including apps.

How are you benefiting from these major trends taking place right before our eyes?

to search and came upon a really good book called “

to search and came upon a really good book called “