The Power of the Crowd

I wrote a blog in July 2011 called “What Disruptive Technology is Sneaking Up on You?” I also wrote another one more recently called “Crowdfunding, the Savior for the Entrepreneur.” Interestingly, they have both been pulled together by the disruptive technology guru Clayton Christensen. Clayton spoke with CNNMoney for an article they featured on his involvement in crowdfunding.

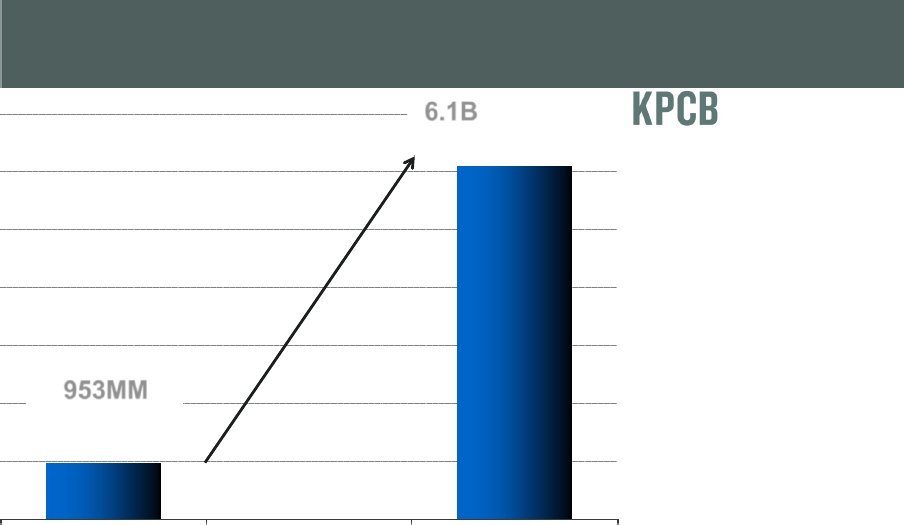

As I explained in my previous blog, crowdfunding will allow companies to raise money with their social contacts for partial ownership in a company. You can raise a lot of money by asking for small investments from a large number of people. Think of this like a  mutual fund that has lots of money to invest, but one individual investor may only put in $500 while another puts in $10,000. Crowdfunding gives the investor the opportunity to invest in people they know even if they don’t have large sums of money. The previous laws placed tight limitations on this.

mutual fund that has lots of money to invest, but one individual investor may only put in $500 while another puts in $10,000. Crowdfunding gives the investor the opportunity to invest in people they know even if they don’t have large sums of money. The previous laws placed tight limitations on this.

Clayton pulls disruptive technology and crowdfunding together when he points out that crowdfunding has the potential to disrupt traditional financiers. He has invested in a platform that is being created to help bring together both the investor and the company trying to raise more capital.

As I’ve said before, I think this opportunity is going to be big! It will change the game for many people, most importantly the entrepreneur. Ideas and opportunities that would have never gotten off the ground before will now have a better chance at a good start and could become job creating machines.

Now, the important ingredient for anyone with aspirations to grow and get funding is a strong social network. The theme we had back in my investment days was connectivity. We invested in companies that were creating the infrastructure which would bring us together. We have all heard “it’s who you know, not what you know.” This rings even truer today with a major focus on people.

What are you doing to grow your social network?